VAT in Switzerland will be increased as of 01.01.2024. The standard rate will increase from 7.7% to 8.1%. The following blog post already takes the new sales tax into account.

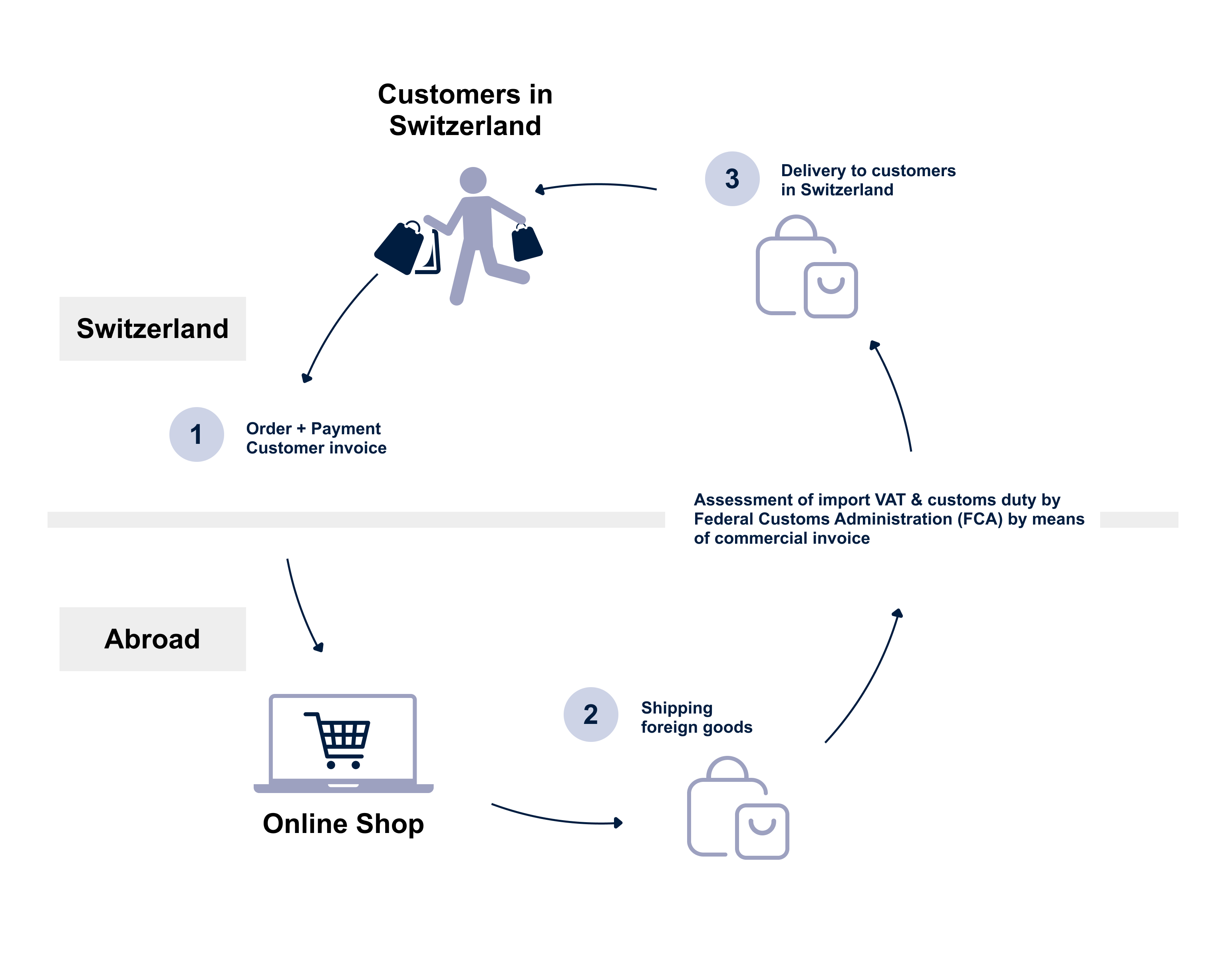

The Swiss customer orders the goods (e.g. a pair of trousers) in the foreign online store and pays the online store the net value of the goods and the Swiss value added tax (VAT) of 8.1% standard rate or 2.6% at the reduced tax rate on the basis of the accounts receivable invoice sent. The foreign online shop then sends the goods to the end customer in Switzerland using a logistics company. Before it reaches the end customer, the goods are declared at the Swiss border either by the logistician or a customs official using a commercial invoice.

Through the commercial invoice, the customs declarant knows which information is entered into the system of the Federal Office for Customs and Border Security (BAZG). have to be entered. Important delivery information is here

- the net value of goods

- the weight and

- if available, the customs tariff number.

Once the customs declarant has entered the information in the BAZG system, the assessment of import VAT and customs duty is made. After that, the goods are then DDP, i.e. taxed and duty paid in Switzerland. The customer is no longer the importer of the goods, but receives the goods from the foreign online shop already taxed and duty paid. The foreign online shop thus imports the goods into Switzerland in its own name using its own Swiss VAT number, company identification number (UID), declaration of subordination and ZAZ account. You can find an example of a commercial invoice for the import assessment

here

.

Customs duty, insofar as it is levied, represents an expense for the foreign online shop. If the goods are of EU origin, no customs duty is owed when importing them into Switzerland. The import sales tax, on the other hand, is not an expense for the online retailer. The import sales tax is only a backup tax and will be refunded in the quarterly sales tax statement in Switzerland. The import sales tax is assessed by the BAZG when crossing the border and is payable within 60 days.

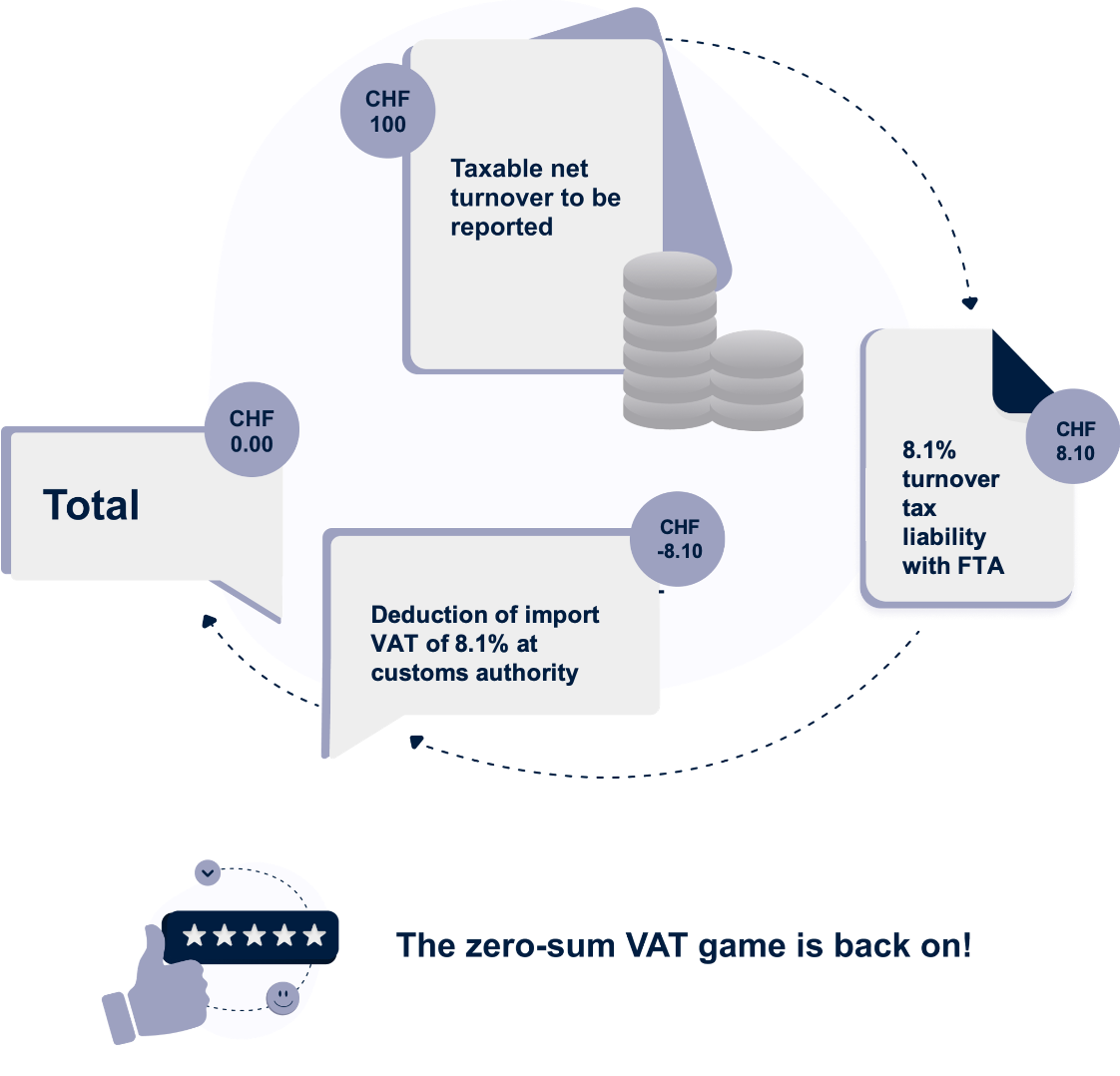

Import sales tax assessment when importing into Switzerland

For an import into Switzerland with a net value of CHF 100, the import sales tax is CHF 8.1 (VAT standard rate of 8.1%). The receipt for the import VAT is provided digitally by the Federal Customs Administration. GJS downloads this import VAT receipt digitally using software certified by the Federal Customs Administration and archives it in the system in an audit-proof manner. If GJS then carries out the quarterly VAT settlement, the import VAT already paid can be evaluated over a certain period and transferred to the VAT settlement. As can be seen in the following graphic, the zero-sum game of VAT for the foreign online retailer is working again.

Quarterly sales tax statement in Switzerland

The right shipping strategy will make you, as a foreign online shop, successful from day one in Switzerland. With a DDP delivery, taxed and customs cleared, you will achieve the highest customer satisfaction and thus meet the specific customer needs in Switzerland. You deliver and charge like local online stores in Switzerland.

An expert from GJS will be happy to help you set up the process optimally and avoid tax and customs traps